Decentralized exchanges that use automated market makers now account for 93% of the market

[ad_1]

A recent report from Consensys indicates that the increase in Decentralized Exchange (DEX) volumes in the third quarter of 2020 is due to their adoption of Automated Market Maker (AMM). According to the report, DEXs that use AMM, software that algorithmically creates token pairs, now account for 93% of the market.

The good side of MAs

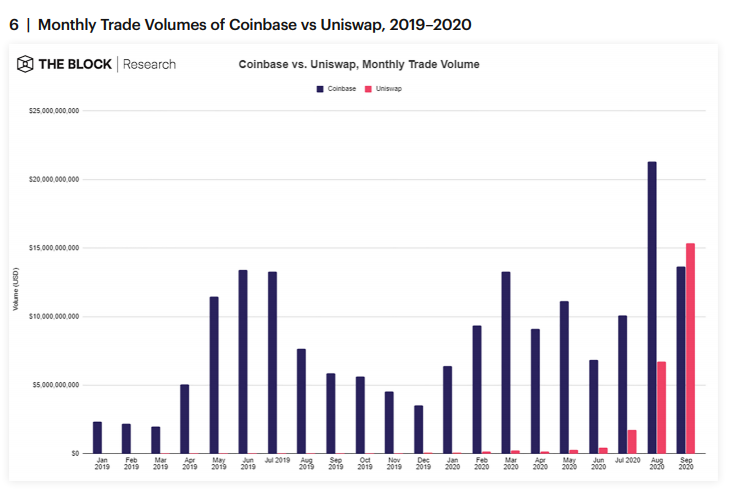

Already, due to the use of AMM, Uniswap’s September traded volume exceeded $ 15.4 billion, a figure nearly $ 2 billion more than Coinbase’s. Before the boom in the use of marketing authorizations, order books were rather used.

The Consensys Defi report states that the increase in the use of MAs is in large part due to the fact that they are “seen as a valuable means of reducing the risks of human error or manipulation and also to leave a trail of harm. ‘clear audit to regulators’.

According to an excerpt from the report, “the market maker software’s” success in the third quarter proved that MAs were ready for the general public – so much so that the total value of MAs on Ethereum exceeded $ 4 billion. “

The main difference between MAs and order books is that liquidity providers do not compete for order flow. All liquidity providers only use liquidity at prices set by the one algorithm that applies to everyone. The entire order flow is distributed proportionally among all liquidity providers.

The counter-narrative

However, many members of the Defi community space argue against AMMs despite the membership of DEX. Dmytro Volkov, CTO of CEX.IO, explains a key point in this regard:

“(A) AMM creates an inefficient market! Arbitrators take advantage of inefficiencies in liquidity providers, meaning that liquidity providers suffer a loss (or lose profits) to make this possible. This makes these markets very attractive to arbitrageurs as they offer essentially risk-free profits. “

Volkov also notes that “inefficient liquidity providers face arbitrageurs, who are professional or very experienced traders with fast and high quality arbitrage algorithms.” According to him, the outcome of such a scenario is quite predictable, professional traders will prevail.

So while the Defi report attributes the increase in DEX volume to the use of MAs, Volkov believes that liquidity providers who currently use this market-making technology are only using it for the sake of “simplicity.” despite the possibility that they will incur losses.

Reiterating the same point of inefficiency, Sam Bankman Fried (SBF), CEO of FTX, whose Tweeter in October argues that “liquidity providers make a mistake and bleed at impermanent loss (IL) but don’t realize it”. CEO, who says AMMs exist “because blockchains don’t have the throughput to support order books,” says IL is just a “PC euphemism for making bad transactions “.

It is when a liquidity provider has a temporary loss of funds due to the volatility of a trading pair.

No sustainable use cases

In its long Twitter thread, SBF finally concludes that “AMMs oblige you to always make two-sided markets in the middle. This strategy usually doesn’t work so well. And throwing in math, or synthetic hurdles, or whatever, doesn’t really help. “

In the meantime, John David Salbego, founder and CEO of Anrkey X praises the “math, algorithms and initial premises†of MAs, but asserts that “there is no real use case where sustainability with marketing authorizations in their current state â€.

Salbego, who generally shares the same sentiments as SBF and Volkov, is also concerned about other issues plaguing MAs such as high ETH gas fees, arbitrage, market price fluctuations and the risk of no filling. . Unsurprisingly, IL is cited as another hurdle, as Salbego explains:

“Also, I think controlling your IL is another major challenge holding back this technology, but I see some cool projects working on solutions that look really promising. “

Dissenting opinion

However, other players like Viacheslav Akhmetov, the blockchain leader at Mercuryo.io, remain optimistic about his outlook. Akhmetov points out that the concept of “AMM is still emerging and that there are many new things that could be introduced”.

Others believe that using a different blockchain might produce better results. Still, they recognize that the current popularity of the Ethereum blockchain makes it difficult to switch between chains.

What do you think of the role of MAs? Share your views in the comments section below.

Image credits: Shutterstock, Pixabay, Wiki Commons

[ad_2]

Comments are closed.