Ametek Stock: Near Gains, According to Market Maker Coverage (NYSE: AME)

Pgiam/iStock via Getty Images

Investment thesis

You just read it verbally, now watch it work in practice on a comparison of portfolio choices, evenly between Ametek Inc. (AME) and such as OEM inventories.

Description of the company concerned

AMETEK, Inc. manufactures and sells electronic instruments and electromechanical devices worldwide. It operates in two segments, Electronic Instruments (EIG) and Electromechanical (EMG). The Company’s EIG segment offers advanced instruments for the process, aerospace, energy and industrial markets; Its EMG segment offers electrical connectors and electronic packaging designed to protect sensitive devices and critical electronic components. AMETEK, Inc. was founded in 1930 and is headquartered in Berwyn, Pennsylvania.”

Source: Yahoo Finance

Yahoo finance

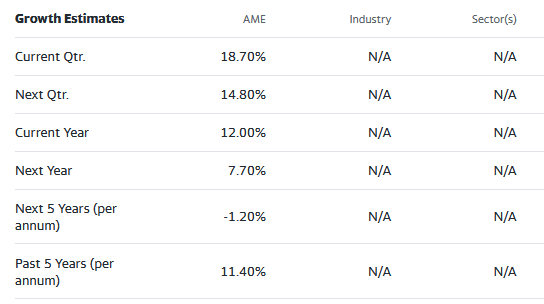

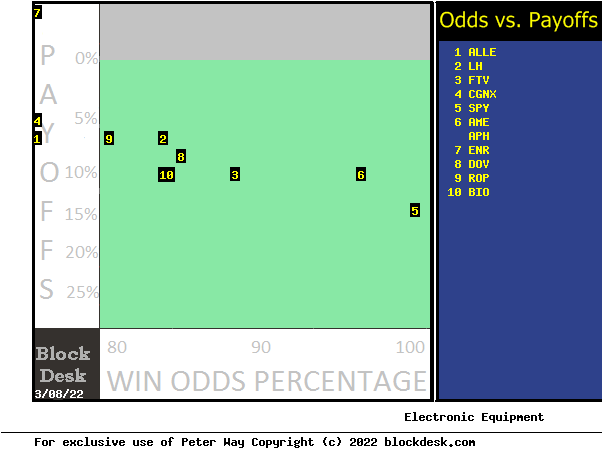

Equipment Manufacturer Inventory Risk-Reward Comparisons

Figure 1

blockdesk.com

(Used with permission)

The trade-offs here are between short-term upside price gains (green horizontal scale) considered worth protecting by market makers with short positions in each of the stocks, and past actual price declines experienced during of the holding of these shares (red vertical scale) . Both scales are percent change from zero to 25%.

The intersection of these coordinates with the numbered positions is identified by the stock symbols in the blue field to the right.

The dotted diagonal line marks the points of equal upward price change predictions derived from Market-Maker [MM] hedging actions and actual worst-case price declines from positions that could have been taken as a result of earlier MA predictions like today’s.

Our primary interest is in ARGX at the location [16]. A “market index” standard of reward-risk trade-offs is offered by the SPDR S&P 500 index ETF at [21].

These predictions are underpinned by the self-protective behaviors of MMs that typically need to put company capital at temporary risk to balance the interests of buyer and seller by helping capital-intensive portfolio managers adjust multi-billion dollar portfolio volumes. The hedging measures taken with real money betting daily define the magnitude of probable price changes expected for thousands of stocks and ETFs.

This map is a good starting point, but it can only cover some of the investment characteristics that must often influence an investor’s choice of where to invest their capital. The table in Figure 2 covers the above considerations and several more.

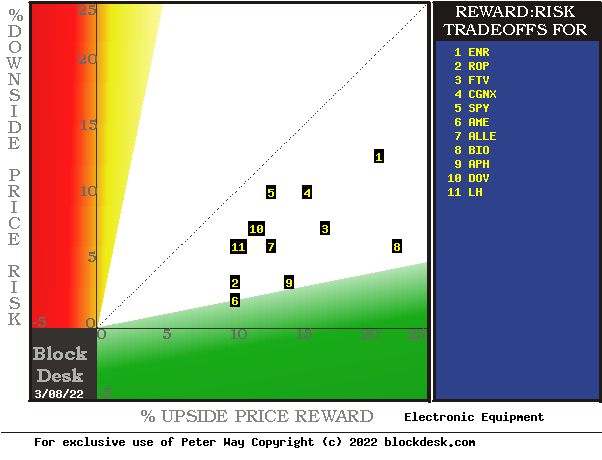

Compare alternative investments

Figure 2

blockdesk.com

(Used with permission)

The column headers in Figure 2 define the items for each rank stock whose symbol appears to the left in the column [A]. The elements are derived or calculated separately for each stock, depending on the specifics of its situation and the forecast of the current MM price range. Data in red numbers is negative, usually undesirable for “long” positions. Table cells with “fillers” on a pink background signify generally unacceptable conditions for “buying” recommendations. The yellow fills are data for the main stock of interest and any issues in the ranking column, [R].

Readers familiar with our analytical methods may wish to skip to the next section displaying the price range forecast trends for AME.

The purpose of Figure 2 is to attempt universally comparable answers, stock by stock, of a) how SIGNIFICANT the gain in price may be, b) what is the LIKELIHOOD that the gain will be a profitable experiment, c) in what time frame this may occur, and d) what RISK of a price decline may be encountered during its holding period.

Column price range prediction limits [B] and [C] be defined by MM’s hedging actions to protect the firm’s capital which must be exposed to the risk of price changes from volume trade orders placed by large $”institutional” clients.

[E] measures the potential upside risks for the short MM positions created to execute these orders and rewards the potentials for the buy positions thus created. Past forecasts like this provide a history of relevant risk of lower prices for buyers. The most severe actually encountered are found in [F]during the periods of maintenance in the effort to reach [E] earnings. This is where buyers are most likely to accept losses.

[H] indicates what proportion of the [L] sample of similar past predictions made gains by causing the price to reach its [B] target or be above sound [D] cost of entry at the end of a maximum holding period limit of 3 months. [ I ] gives the net gains-losses of those [L] experiences and [N] suggests how much [E] can be compared to [ I ].

Other reward-risk trade-offs involve the use of [H] win odds with loss odds 100 – H as weights for N-conditioned [E] and for [F]for a combined yield score [Q]. The typical job retention period [J] to [Q] provides a symbol of merit [fom] ranking measure [R] useful in portfolio position preference. Figure 2 is arranged by row on [R] among the candidate titles, with EW ranked first.

In addition to candidate-specific stocks, these selection considerations are provided for the averages of nearly 3,500 stocks for which MM price range predictions are available today, and 20 of the top-ranked (per of) of these forecasts, as well as the forecast for the S&P 500 Index ETF (NYSEARCA:SPY) as a proxy for the stock market.

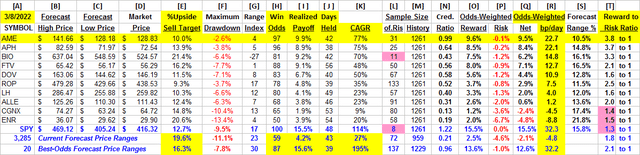

Recent trends in the MM price range SOUL Forecasts

picture 3

blockdesk.com

(Used with permission)

This picture is do not a “technical sheet” of past prices for AME. Instead, it’s the last 6 months of daily price scale forecasts upcoming market actions in the coming months. The only past information is the closing price of the stock on the day of each forecast.

This data divides the opposite predictions of the price range into bullish and bearish outlooks. Their trends over time provide additional insight into upcoming potentials and help keep perspective on what may be to come.

The small image at the bottom of Figure 3 is a frequency distribution of the daily appearance of the Range Index over the last 5 years of daily forecasts. The range index [RI] indicates how much the decline in the forecast range occupies that percentage of the entire range each day, and its frequency suggests what may seem “normal” for this stock, in the eyes of evaluators.

Here, the current level is close to its least frequent and least expensive occurrence, encouraging acceptance that we are looking at a realistic valuation for the AME. With almost all of the RIs moving above the current RI than below, there is ample room for an even more positive outlook.

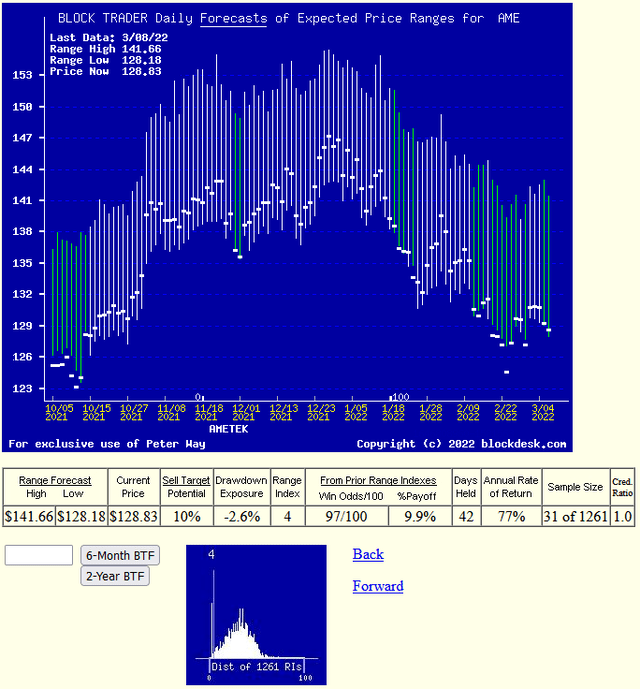

Prospect of past profitability of investment candidates

Figure 4

blockdesk.com

(Used with permission)

This comparison map uses an orientation similar to Figure 1, where the most desirable locations are bottom and right. Instead of being limited to price direction, the questions are more qualitative: “how big” and “how likely” are expectations of price changes now?

Our main interest is the qualitative performance of AME, in particular in relation to the choices of alternative investment candidates. Here AME is at the location [6]the intersection of the horizontal and vertical scales of +10% gain and +97% insurance (chances of “winning”).

As an industry standard, SPY is at the location [5] with a gain of +7% and 100% profitability assurance. This is a very unusual posture for the ETF index most often seen as an overall picture of stock valuations.

The international unrest created by Russia’s invasion of Ukraine is undoubtedly a major factor here. SPY is rarely at a range index as low as 17. This suggests that 5/6 of the prospective price changes for the market ETF will occur on the upside. More than 83% of a price range of almost +16% could be reserved for equity investors. Although the “win odds” of this level may be 100 out of 100, it is never a certainty. And the scope of a maximum market rise can be momentary, providing little time or ability to turn equity holdings into cash at the peak.

Yet the current picture is one of considerable optimism across the broad market front.

Conclusion

Among these alternative investments explicitly compared, Ametek Inc. seems like a logical buying preference now for investors looking for short-term capital gain.

Additional disclosure: Peter Way and generations of the Way family are long-term providers of insight information, previously helping professional investors and now individual investors, to distinguish between wealth-building opportunities in individual stocks and ETFs. We do not manage money for others outside the family, but provide pro bono advice to a limited number of non-profit organizations.

We strongly believe that investors should keep their skin in their game by actively initiating capital commitment choices and time investments in their personal portfolios. Thus, our information presents for DIY investors what the most informed professional investors think. Their insights, revealed by their own self-hedging hedging actions, indicate what they believe is most likely to happen to specific issue prices in the weeks and months ahead. Evidence of how these past predictions have worked is regularly provided on our SA blog under my name.

Comments are closed.